Reiterates 2023 Guidance of Revenue up 59%-74% to $43 million-$47 million, Driving Positive Operating Income, Cash Flow and Adjusted EBITDA

High Wire Networks, Inc. (OTCQB: HWNI), a leading global provider of managed cybersecurity and technology enablement, reported results from continuing operations on a pro forma basis for the quarter and year ended December 31, 2022. All comparisons are to the same year-ago period unless otherwise noted.

On March 8, 2023, High Wire announced the sale of its legacy staffing business. The following pro forma financial results exclude this divested business and provides only the results from the company’s continuing managed cybersecurity and technology enablement business. GAAP results for the full year 2022 can be found at www.sec.gov in the company’s annual report as filed on Form 10-K.

Financial Highlights

- Fourth quarter revenue up 34% to a record $8.3 million, with full year up 26% to a record $26.8 million.

- Total contract value (TCV or backlog) for the company’s Overwatch managed cybersecurity business totaled a record $5.0 million at year end and is currently at $5.7 million (see TCV definition, below).

- For the full year, net loss totaled $11.3 million, improving 51% from 2021. Net loss on a non-GAAP basis for the full year 2022 totaled $5.3 million (see definition of this non-GAAP term and reconciliation to GAAP, below).

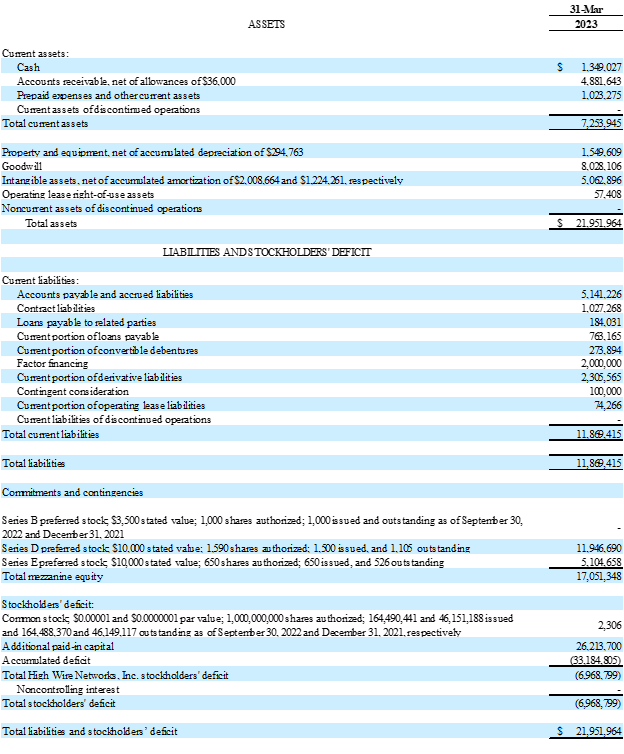

- Cash totaled $649,000 at December 31, 2022, compared to $508,000 at December 31, 2021. As of March 31, 2023, cash totaled $1.3 million.

Q4 2022 Operational Highlights

- High Wire’s channel partner network, which includes industry leading organizations that cater to the Fortune 500, expanded by 22% to more than 624 partners by the end of 2022. The new channel partners are comprised of 78 for the company’s Overwatch managed cybersecurity offering and 36 for its tech enablement services business. The company estimates the new tech enablement channel partners collectively generate more than $50 billion in annualized revenue, of which $20 billion represents addressable new business opportunities for security, IT and related solutions.

- Secured a multi-site, multi-technology Wi-Fi deployment project for a major U.S. retailer which recently expanded to a total contract value of more than $12 million. Awarded through a High Wire channel partner and global systems integrator, the project spans thousands of stores across the U.S and U.S. territories.

- Awarded a $1.8 million government phone deployment contract through a value-added reseller and channel partner for a telecommunications system lifecycle refresh project. The upgrade expected to deliver more than 60,000 new IP telephones to 433 U.S. government sites.

- Appointed IT executive Stephan Tallent, CISSP, as chief revenue officer of the Overwatch managed cybersecurity division, bringing more than 20 years of managed security services experience to the team.

- Initiated the integration of the company’s proprietary Overwatch Security Orchestration Automation and Response™ (SOAR™) technology at its 24/7 network and security operation centers in Batavia, Illinois, and completed the integration in the first quarter of 2023. SOAR automatically consolidates alerts from various threat prevention and detection-and-response platforms, providing enhanced visibility, improved correlation and faster remediation.

Outlook

For the full year 2023, High Wire continues to expect pro forma revenue from continuing operations to grow 59% to 74%, reaching $43 million to $47 million, with this driving positive operating income, cash flow and adjusted EBITDA.

Management Commentary

“In Q4, much of our record top-line and bottom-line improvement was driven by strong recurring revenue growth generated by our cybersecurity and technology managed services, which we now provide to nearly 1,000 SMB and enterprise customers worldwide,” stated High Wire CEO, Mark Porter.

“The rapid growth of this userbase reflects the increasing strength of our channel partner network—now at more than 624 partners worldwide—as well as the critical importance and effectiveness of the services we provide.

“Our strong value proposition and growing presence in our marketplace has attracted increased industry recognition. Across a field of more than 120 competitors, in February Frost & Sullivan ranked us among the Top 12 Managed Security Service Providers that are delivering the greatest results in the categories of growth and innovation. CRN also recently named us to its MSP 500 and Elite 150 lists for 2023.

“During the fourth quarter, we implemented a new cost containment and margin improvement program. This was combined with a strategic recapitalization plan designed to strengthen our capitalization and organizational structure; eliminate high interest convertible debt and dilutive convertible provisions; secure more favorable credit and financing; and prepare us for a listing on a major U.S. stock exchange.

“A key part of this plan was the divestiture of our slower-growing, lower margin legacy staffing business. In March, we completed this sale in a $11.5 million transaction that canceled outstanding debt and reduced shares of our Series D preferred. This effectively eliminated $325,000 in monthly debt payments and freeing up substantial capital that we are now using to support our faster-growing, higher-margin managed cybersecurity and technology business.

“Combined with a subsequent loan conversion, the transactions reduced our fully diluted share count by a total of 17% or approximately 60.3 million shares through the elimination of conversion provisions associated with the debt and preferred equity.

“Now with much of our transformative plan complete, in the first quarter of this year it has resulted in stronger revenue growth, expanded gross margin, and a much more optimal capitalization structure, and with further improvements expected throughout the year. In fact, we anticipate reporting more than 75% in pro forma revenue growth in the first quarter of 2023 as compared to the same year ago quarter—a much higher growth rate without the staffing business.

“Another key driver for growth is the now deeper implementation of our Overwatch SOAR™ cybersecurity technology which enabled us to consolidate and onshore our network and security operation center in February. This significantly strengthened our cybersecurity infrastructure and processes, including reducing the workload at our network and security operation center by a factor of 125x. It has also translated into lower overhead and expanded our gross margins.

“The greater efficiency provided by SOAR also allows us to rapidly scale the delivery of our Overwatch offerings, including adding new channel partners and end customers. We believe we can now double or even triple the associated revenue without additional headcount. We are also seeing more existing clients adding additional services.

“We have already seen a 430% expansion in Overwatch customers over the past year, with this resulting in a record total contract value for Overwatch that is currently at more than $5.7 million. Our forecasting continues to improve, and we anticipate signing major new contracts, renewals and expansions in the first half of the year, and this leading to substantial revenue recognition in the second half.

“Our sales pipeline continues to expand and convert into wins such as our recently announced award of a $5.3 million mobile Wi-Fi access refresh project for a nationwide retail store chain. It was secured through one of our premier global channel partners who has delivered more than $35 million in projects to us over the past several years. This win follows a similar engagement we signed last fall that has now expanded from $5 million to a $12 million project. Earlier this year we also secured an expanded three-year, $300,000 contract renewal to provide Overwatch for a global aerospace company.

“Together with the rapid growth in Overwatch and new services and programs we plan to introduce in 2023, these wins support our outlook for revenue growth of 59% to 74% in 2023, reaching $43 million to $47 million. We see this growth being increasingly comprised of recurring revenue under long-term contracts, and this driving positive operating income, strong cash flow and positive adjusted EBITDA.

“Our positive outlook and strengthened cap structure and balance sheet allows us to advance towards an up-listing to a major exchange. We anticipate such a listing to provide greater liquidity and enhanced value for our shareholders, as well as greater confidence and prestige among our channel partners and end-customers.”

Q4 2022 Financial Summary (Continuing Operations Pro Forma)

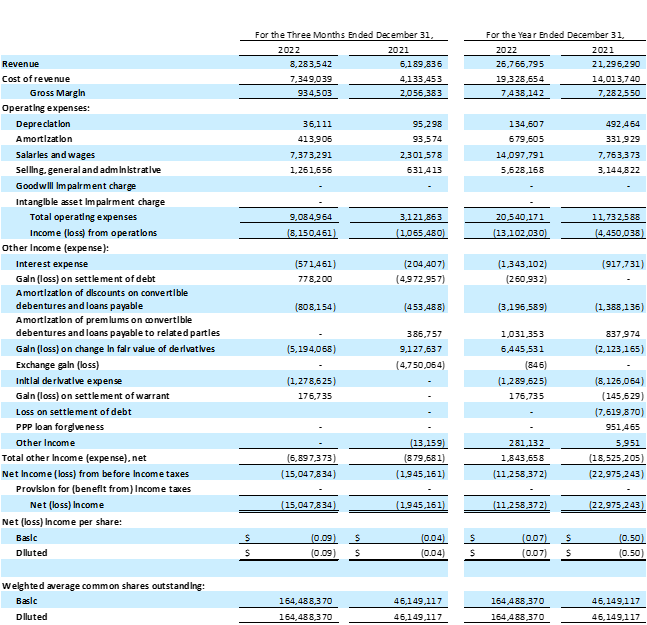

Revenue in the fourth quarter of 2022 totaled $8.3 million, up 34% from $6.2 million in the same year-ago quarter. The increase was primarily due to a substantial increase in technology enablement projects, as well as strong growth in recurring revenues.

Gross profit totaled $935,000 or 11.3% of revenue in the fourth quarter as compared to $2.1 million or 33.2% of revenue in the same year-ago quarter. The decrease was primarily attributable to a project that was subsequently re-negotiated, allowing a return to normalized margin levels in the first quarter of 2023.

Total operating expenses increased to $9.1 million compared to $3.1 million in the same year-ago quarter. The increase was primarily due to non-cash stock-based compensation of $5.8 million with the majority attributed to the issuance of the remaining Series D Preferred associated with the reverse merger in June 2021. Excluding the non-cash stock-based compensation, total operating expenses were $3.3 million.

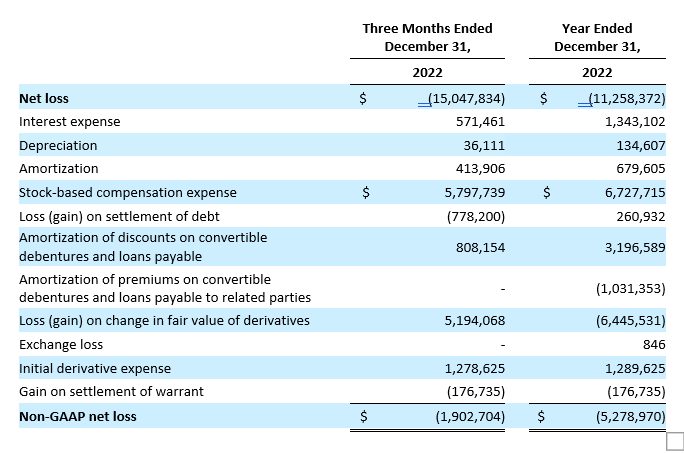

Net loss for the fourth quarter of 2022 totaled $15.0 million or $(0.09) per share compared to a net loss of $1.9 million or $(0.04) per share in the same year-ago period. Net loss on a non-GAAP basis for the fourth quarter of 2022 totaled $1.9 million (see reconciliation to GAAP, below).

Cash and cash equivalents totaled $649,000 at December 31, 2022, as compared to $508,000 at December 31, 2021. As of March 31, 2023, cash totaled $1.3 million.

Full Year 2022 Financial Summary (Continuing Operations Pro Forma)

Revenue in 2022 totaled $26.8 million, up 26% from $21.3 million in 2021. The increase was primarily due to a substantial increase in revenues from the company’s Overwatch managed cybersecurity business and technology enablement projects.

Gross profit totaled $7.4 million or 27.8% of revenue as compared to $7.3 million or 34.2% of revenue in 2021. The decrease in gross margin was primarily attributable to a project that was subsequently re-negotiated, allowing a return to normalized margin levels in the first quarter of 2023.

Total operating expenses increased to $20.5 million compared to $11.7 million in 2021. The increase was due to increased costs for supporting the company’s sales growth and business development, along with various expenses that were incurred due to R&D investments in the company’s proprietary Overwatch Security Orchestration Automation and Response™ (SOAR™) technology. The increase in total operating expenses was also due to fully onshoring the security operations center. The most substantial increases were in salaries and benefits, of which $6.7 million was attributable to non-cash stock-based compensation charges.

Net loss for 2022 totaled $11.3 million or $(0.07) per share compared to a net loss of $23.0 million or $(0.50) per share in 2021. Net loss for 2022 on a non-GAAP basis totaled $5.3 million.

About High Wire Networks

High Wire Networks, Inc. (OTCQB: HWNI) is a fast-growing, award-winning global provider of managed cybersecurity and IT enablement services. Through more than 600 channel partners, it delivers trusted managed services for nearly 1,000 managed security customers and tens of thousands of technology customers. Its end-customers include hundreds of Fortune 500 companies and the nation’s largest government agencies.

The company’s Overwatch by High Wire Networks™ platform offers a range of subscription services for threat prevention, detection and response to meet the security and compliance requirements of organizations large and small. The company’s IT enablement services provide the foundation for growing its higher-margin Overwatch business.

High Wire has 125 full-time employees worldwide and four U.S. offices, including a U.S. based 24/7 Network Operations Center and Security Operations Center in Chicago, with additional regional offices in Puerto Rico and United Kingdom.

High Wire was recently ranked by Frost & Sullivan as a Top 12 Managed Security Service Provider in the Americas. It was also recently named to CRN’s MSP 500 and Elite 150 lists of the nation’s top IT managed service providers.

Learn more at HighWireNetworks.com. Follow the company on Twitter, view its extensive video series on YouTube or connect on LinkedIn.

Total Contract value

The company defines total contract value (TCV) as the aggregate monetary value of its customer contracts remaining under the duration of the contracts, including associated one-time fees, such as onboarding and training fees.

Use of Non-GAAP Financial Measures

The company believes that the use of certain non-GAAP measures can be helpful for an investor to assess the performance of the company. The company defines income (loss) on a non-GAAP basis (or “non-GAAP income (loss)”) as net income (loss) before interest expense; depreciation; amortization; stock-based compensation; settlement of debt; amortizations of discounts and premiums on convertible debentures and loans payable; change in fair value of derivatives; exchange loss; derivative expense; and gain on settlement of warrants. The company defines adjusted EBITDA similarly to non-GAAP net income (loss).

Non-GAAP income (loss) is not a measurement of financial performance under generally accepted accounting principles in the United States, or GAAP. Because of varying available valuation methodologies, subjective assumptions and the variety of equity instruments that can impact a company’s non-cash operating expenses, the company believes that providing a non-GAAP financial measure that excludes non-cash and non-recurring expenses allows for meaningful comparisons between its core business operating results and those of other companies, as well as providing the company with an important tool for financial and operational decision making and for evaluating its own core business operating results over different periods of time.

The company’s non-GAAP income (loss) measure may not provide information that is directly comparable to that provided by other companies in our industry, as other companies in its industry may calculate non-GAAP financial results differently, particularly related to non-recurring and unusual items. The company’s non-GAAP income (loss) is not a measurement of financial performance under GAAP and should not be considered as an alternative to operating income or as an indication of operating performance or any other measure of performance derived in accordance with GAAP. The company does not consider non-GAAP income (loss) to be a substitute for, or superior to, the information provided by GAAP financial results. The following table reconciles non-GAAP net income (loss) to GAAP income (loss):

High Wire Networks, Inc.

Consolidated Pro Forma Statement of Continuing Operations

(Unaudited)

High Wire Networks, Inc.

Consolidated Balance Sheet as of March 31, 2023

(Unaudited)